Key Takeaways:

-

Understanding the ERTC’s impact on commercial real estate is crucial for stability.

-

Navigating tax credit adjustments requires a proactive approach and expert advice.

-

Compliance with IRS regulations can safeguard against financial pitfalls.

-

Geographical factors significantly influence commercial real estate trends.

-

Adapting to the hybrid work model is essential for the future of office spaces.

Claim your ERTC Rebate Now

ERTC’s Influence on Commercial Real Estate Stability

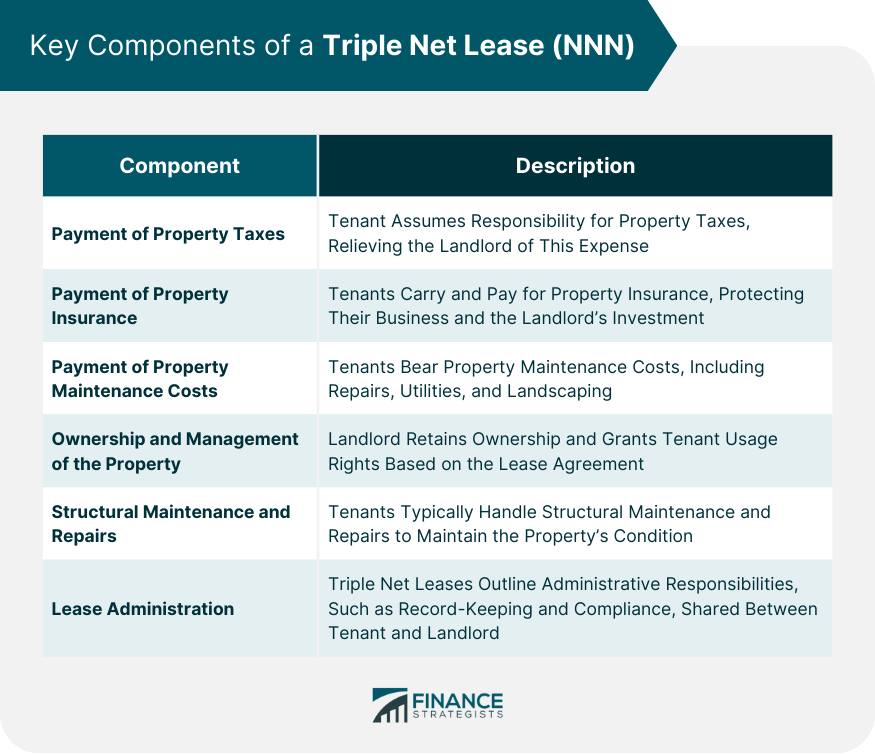

“Triple Net Lease (NNN) | Meaning, Key Components, Pros & Cons” from financestrategists.com and used with no modifications.

The Employee Retention Tax Credit (ERTC) has been a lifeline for many businesses during challenging economic times. However, its influence extends beyond immediate cash flow relief; it impacts the stability of commercial real estate (CRE) markets. Let’s dive into how this interplay affects your investment decisions.

Key Takeaways: Evaluating the Current Landscape

Before we jump into the nitty-gritty, let’s outline the current CRE landscape:

-

Industrial and warehouse sectors are booming, while office spaces struggle.

-

Geographic location is becoming a make-or-break factor in property value.

-

ERTC changes are causing ripples in CRE investment strategies.

IRS Announcement IR-2023-193: Impact on Real Estate Businesses

Recent IRS announcements have put the spotlight on ERTC claims. Real estate businesses that have taken advantage of these credits must now tread carefully to ensure compliance and avoid audits. Here’s what you need to do:

-

Review your ERTC claims for accuracy.

-

Prepare documentation to substantiate your eligibility.

-

Stay informed on the latest IRS guidelines.

Optimizing Commercial Ventures Amidst Tax Credit Adjustments

As the ERTC landscape shifts, so must your approach to managing commercial properties. Consider the following:

Adjust your financial projections to account for changes in tax credit availability. This will help you maintain a stable investment portfolio.

Strategizing with Tax Experts: Navigating ERTC Policy Shuffles

Don’t go it alone. Tax experts can be your allies in navigating these complex waters. They’ll help you:

-

Identify opportunities within the new ERTC framework.

-

Ensure your claims are bulletproof against IRS scrutiny.

-

Plan for long-term tax efficiency in your CRE investments.

Dissecting the ERTC Compliance Review Mechanisms

“1031 Exchange Specialist | Overview, Duties, Skills, & Criteria” from financestrategists.com and used with no modifications.

Understanding the IRS’s compliance review mechanisms is like having a roadmap in a dense forest. It guides you through the thicket of regulations and keeps you on the path to success.

Behind the IRS Pause: Understanding Compliance Hurdles

The IRS has paused certain ERTC claims to ensure accuracy and prevent fraud. This means you need to be extra diligent with your filings. Here’s how:

-

Double-check all claim details before submission.

-

Anticipate possible areas of scrutiny and prepare accordingly.

Essentials of Eligibility: Withdrawing ERTC Claims Accurately

Withdrawing an ERTC claim doesn’t have to be a red flag. If done correctly, it can protect your business from future complications. Remember:

-

Withdrawals should be well-documented and clearly communicated to the IRS.

-

Act swiftly upon realizing a claim error to prevent penalties.

Evaluating Audit Risks: When to Seek Professional Guidance

Audits can be intimidating, but with the right preparation, they don’t have to be a nightmare. If you’re uncertain about your ERTC claims, it’s time to seek professional guidance. They’ll help you:

-

Analyze your claims from an auditor’s perspective.

-

Prepare a defense strategy for every aspect of your claim.

Most importantly, remember that the commercial real estate sector is ever-evolving, and staying informed is your best defense. By understanding the implications of the ERTC on your CRE investments, you can navigate these challenges with confidence and maintain a stable and profitable portfolio.

Ensuring Robust CRE Investment Strategies Post-ERTC Restructuring

“Commercial Property Management – Kelley Connect” from kelleyconnect.com and used with no modifications.

Now, let’s focus on fortifying your investment strategies in light of the ERTC changes.

Industrial and Warehouse Market Analysis: Thriving Amid Decline

While office spaces may be facing a downturn, the industrial and warehouse sector is experiencing a boom. Here’s what you should do:

-

Consider diversifying your portfolio to include industrial properties.

-

Analyze market trends to identify high-demand areas.

Real Estate Investment Trusts (REITs): A Buffer Against CRE Downturns

REITs can be a safe haven during turbulent times in the CRE market. They offer:

-

Exposure to a diversified portfolio of real estate assets.

-

Professional management that can navigate market shifts.

Hybrid Work Model: Its Complex Effects on CRE Values

The rise of hybrid work models has transformed the demand for office space. Adapt by:

-

Reimagining office layouts to cater to flexible work arrangements.

-

Investing in technology and amenities that support a hybrid workforce.

Geographical Impact on Commercial Real Estate Trends

Location, location, location. It’s not just a cliché; it’s a critical factor in CRE success.

Core Urban Centers vs. Suburban Spaces: Divergent CRE Trajectories

Urban and suburban markets are diverging. To stay ahead:

-

Monitor migration patterns and demographic shifts.

-

Invest in properties that align with these trends.

Critical Delinquency Rates: How Location Influences CRE Health

Delinquency rates can be a telltale sign of a property’s financial health. Keep an eye on:

-

Local economic indicators that may affect delinquency rates.

-

Strategies to mitigate risk in higher delinquency areas.

Banks and Insurance Companies: Gauge on Exposure and Fallout Risks

Banks and insurance companies play a significant role in the CRE market. Understanding their positions can give you insights into the market’s stability.

Assessing CRE Declines: Bank Exposure at a Manageable Scale

Despite some alarming headlines, bank exposure to CRE is generally manageable. Still, you should:

-

Stay informed about the financial health of your lenders.

-

Prepare for potential tightening in lending criteria.

Insurance Companies: Calculating the Sell-off and Policy Risks

Insurance companies are significant players in CRE investments. To navigate this:

-

Understand the regulatory environment affecting these institutions.

-

Anticipate how changes in their investment strategies could impact the market.

Capital Requirements: Buffering Against CRE Market Fluctuations

Capital requirements can act as a buffer against market fluctuations. As an investor:

-

Be aware of how these requirements might affect your financing options.

-

Plan for scenarios where lenders may become more conservative.

Therefore, by staying informed and proactive, you can navigate the complexities of commercial real estate investment in a post-ERTC world with greater ease and confidence. Remember, the key to success in CRE is not just in reacting to changes but in anticipating them and planning accordingly.