An Employee Retention Credit Example will help your business start the application process

The employee retention credit is a tax credit businesses can claim for retaining workers and paying qualifying wages during the COVID-19 pandemic.

As business owners grapple with the financial fallout of the pandemic, retaining employees has become a top priority. The employee retention credit is designed to help businesses keep their workers on the payroll.

Here’s what you need to know about the employee retention credit, including how to claim it and what restrictions apply.

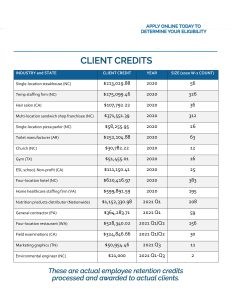

Examples of businesses who have claimed ERTC for their company:

What is the employee retention credit?

The employee retention credit is a refundable tax credit businesses can claim for retaining workers and paying qualifying wages during the COVID-19 pandemic. The credit is worth up to $5,000 per employee.

To be eligible for the credit, businesses must have experienced either a full or partial shutdown due to COVID-19, or a significant decline in gross receipts. For businesses that were not operational in 2020, the credit is available for wages paid from January 1, 2021 through June 30, 2021.

How to claim the employee retention credit

The employee retention credit can be claimed on your business’s quarterly payroll tax return (Form 941). The credit is applied against the employer’s share of Social Security taxes.

If you’re a business owner who pays your employees’ wages personally (e.g., if you’re a sole proprietor), you can claim the credit on your individual income tax in the United States.

What restrictions apply to the employee retention credit?

There are a few restrictions to be aware of when claiming the employee retention credit:

The credit is not available to businesses that receive a Paycheck Protection Program loan.

The credit is capped at $5,000 per employee.

Wages used to calculate the credit must be paid after March 12, 2020 and before January 1, 2021 (for businesses that were not operational in 2020) or July 1, 2021 (for businesses that were operational in 2020).

To claim the full credit, employees must have been paid for all three quarters of 2020 (or all four quarters of 2021 if the business was not operational in 2020). Partial credits are available for employees who were paid for one or two quarters.

Employees who are related to the business owner (e.g., spouses, parents, children) are not eligible for the credit.

The employee retention credit is a valuable tax break for businesses that have been affected by the COVID-19 pandemic. If you’re a business owner, be sure to take advantage of this credit if you’re eligible.

Additional tips for business owners on how to keep their employees during tough times:

- Establish a clear retention strategy.

When business is booming, it’s easy to keep your employees happy and engaged. But during tough times, it’s important to have a clear retention strategy in place so you can keep your best talent on board.

- Communicate openly and frequently.

One of the best ways to keep your employees informed and engaged is to communicate openly and frequently. Let them know what’s going on with the company and share your plans for weathering the storm.

- Offer flexible work options.

During tough times, many employees appreciate the ability to have more flexible work options. If possible, offer things like telecommuting, flexible hours, or compressed work weeks.

- Invest in employee development.

One of the best ways to retain top talent is to invest in their development. Offer opportunities for employees to learn new skills and grow their careers. This will not only help them stay engaged, but it will also make them more valuable to your company.

- Show appreciation.

In tough times, it’s important to show your employees how much you appreciate them. Whether it’s a simple thank-you note or a more substantial bonus, letting your employees know that they are valued will go a long way in retaining them during difficult times.